Astonishing new data from the ABS has laid bare the Queensland Government’s bumper bounty from property tax revenue over FY23, all while the State endures a housing crisis.

The data, which excludes coal royalties, shows stamp duty now accounts for 25 percent of the tax base for the State Government compared to 20 percent ten years ago.

Additionally, property taxes (stamp duty and land tax) have risen by 133 percent (more than doubled) over the past ten years, equating to an additional $4.2 billion per year.

REIQ CEO Antonia Mercorella said given the steep upshoot in property values in the Sunshine State, it was time to reset reasonable parameters of property tax.

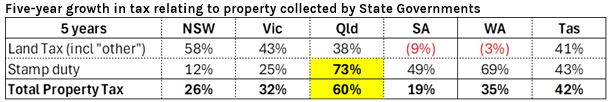

“Over the past five years, Queensland has recorded the highest growth in property taxes of any state,” Ms Mercorella said.

“Even with Victoria increasing taxes on property such as windfall gains tax in that period, Queensland is still taking the cake for escalating tax take.

“Despite record revenue and announcements relating to housing, it’s insulting and ironic that very little is being reinvested back into building social housing – with only 56 completed last year, the lowest on record and the lowest of any state.”

Ms Mercorella said Queensland’s property taxes may target home buyers and property investors, but make no mistake, they have a flow on impact to everyone and the economy.

“Over the last 12 months, Queensland had the lowest proportion of first home buyers of all mainland states for all purchases and owner occupiers,” she said.

“Stamp duty is a financial hurdle that can add years to home buying timelines keeping people in the rental market for longer, and also deters empty nesters from downsizing creating utilisation inefficiencies in our existing housing stock.

“While ongoing and escalating land tax costs are inevitably partially passed on to renters in order to ensure investments still stack up and remain sustainable.

“It’s clear our state’s antiquated property tax system is no longer fit for purpose, and this unhealthy addiction to new highs of property revenue must be tapered and kept in check.

“The REIQ continues to call for the indexation of land tax – the threshold has been set at $600,000 since 2007, so it’s well overdue to readjust the value at which land tax applies.

“While we’ll keep advocating for stamp duty to be completely overhauled, a sensible interim measure would be to lift the stamp duty concessional threshold for first home buyers to $800,000 to reflect modern day prices.

“We understand that thresholds need to be set, but equally there needs to be a mechanism in place to review them.

“At all points in property transactions, some level of government, whether it be state or federal, is also going along for the ride and reaping the benefits too – they all stick their fingers in the property pie, and concerningly that makes for a much less appealing meal.”

ENDS

Media enquiries:

Claire Ryan, Media and Stakeholder Relations Manager, The Real Estate Institute of Queensland

M: 0417 623 723 E: media@reiq.com.au