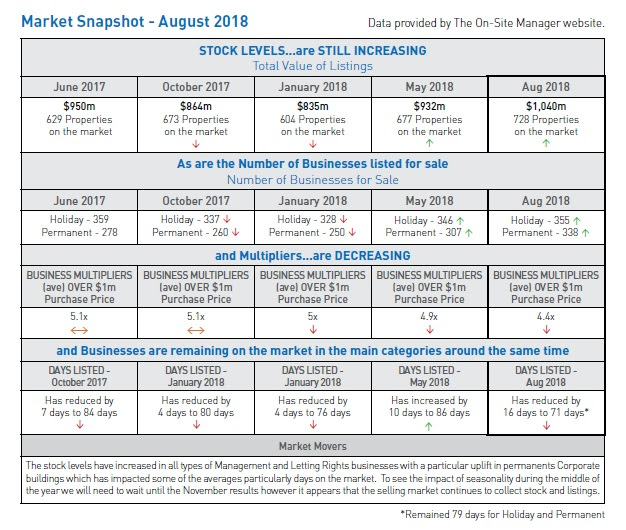

Today we present the fifth in our series of analysis on the selling market for Management and Letting Rights (MLR). We have been collating this data quarterly since June 2017 and the following is a broad summary;

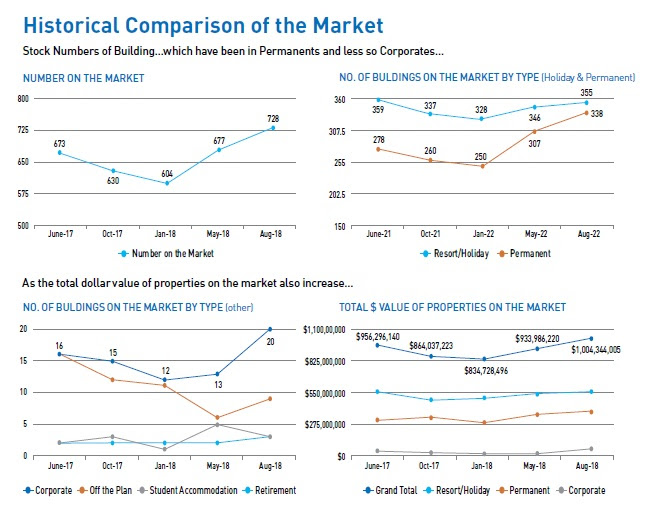

– Stock levels continue their growth which commenced in January 2018. There is now $1b of MLRs on the market.

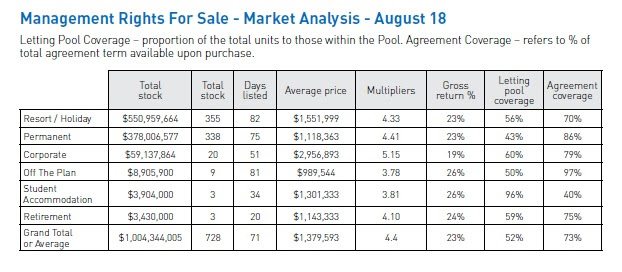

– This has largely been in the Permanent and to a lesser extent the Corporate space.

– The average listing period of all buildings has been 71 days in the last quarter. With an additional 90-100 days to complete settlement.

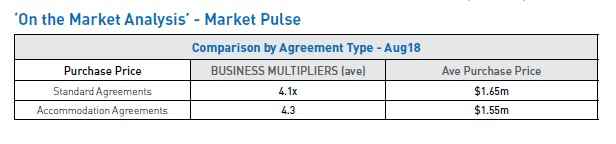

– There is about 0.2x lower multiplier for Standard Agreements over Accommodation Agreements.

– In the Permanent Space buildings are been listed with around 80% of the agreement term available and its lower for Holidays at 70%.

The full details and some simple graphs can be seen below:

FNX is one of the leading arrangers of Finance in the Management Rights space and we pride ourselves on our experience, service and knowledge of the industry.

We welcome any feedback or if you would like to call to ask any further questions on our reports we would love to hear from you!