As some of you will no doubt have figured out by now, I have a weakness for cars. Old cars, new cars, fast cars, slow cars, even electric cars and the occasional motorcycle. I am fascinated by cars and the auto industry. This basic flaw in my good judgement has led to me investing wisely in a few vehicles, much to the dismay of the managing director. By wise investment I mean spending more than said vehicles will ever be worth and then justifying the “investment” by grossly overinflating the values when debating the matter with my accountant, bank manager and afore mentioned MD.

My love of cars is primarily centred around new, fast and flashy and old, restored and beautiful. I am less a’mored with rusty old dungers that, with a bit of love and thousands of dollars, might some day run and be worth a few dollars. The market for such “collectibles” is flaky at best albeit there are plenty of vendors out there trying to make a fast buck selling a substandard vehicle that hasn’t been maintained at a top dollar price.

One of the biggest gatherings of classic car and lifestyle enthusiasts takes place in Coolangatta on the Gold Coast in June each year. Cooly Rocks On is one of the biggest festivals of its sort anywhere and well worth a look. We have been going for the past 5 years and we always stay in the same high rise and always in the same unit. Being a high demand event tariffs are pretty steep and the investors in the area no doubt enjoy a great return. This is as it should be.

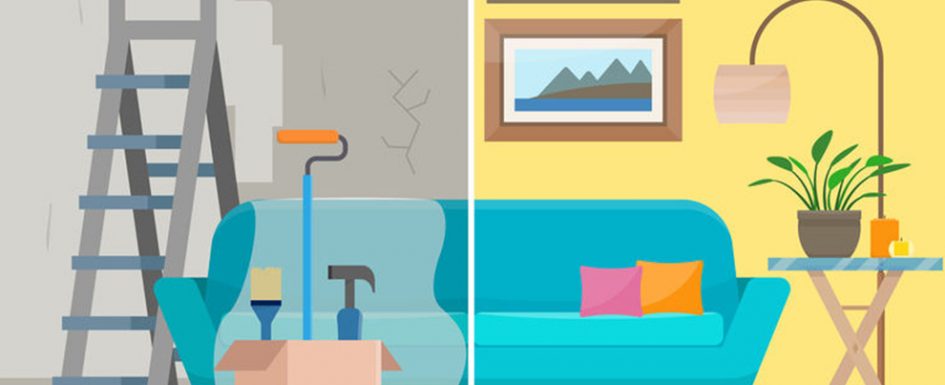

Sadly, and like the car vendor who tries to sell a sad old classic at a restored price, we have watched the condition and presentation of our favourite unit deteriorate over the past 5 years. The trend was evident early on, but the position and view are so sensational that we chose to overlook the falling standards and rebook each year. There is, of course, a tipping point where all the beauty and ambiance of a location cannot compensate for a tired and unloved apartment. I reckon we have a real challenge looming with some of the most magnificent tourism destinations in the world underpinned by some seriously tired and decrepit accommodation stock. The challenge is amplified by the fact that much of this stock is management rights based with resident managers having little control over the capacity or desire of individual owners to keep their apartments up to a suitable standard. In the case of the property I have mentioned above all that is required is some fresh paint, some new furniture, more regimented cleaning standards and an eye for detail. Presenting an apartment at $500 per night with cigarette burns in the dining chairs is not a good look!

Of course, there are many apartments that need a whole lot more than paint and carpet. These days travellers, particularly in the leisure sector, expect standards similar to what they had at home. Back in the day that was easy. No one I knew as a kid had a swimming pool so any motel or holiday flats with a pool was immediately top shelf. Now everyone’s got a pool, a big TV in every room, a gourmet kitchen and a Kim Kardashian signature bathroom. Ok, I made that bit up.

What to do?

Well, if you’re lucky or a very gifted people manager you will have investors in your property who see the value in keeping their apartments in tip top shape. You will keep them constantly informed of guest feedback and encourage tweaks and fine tuning to ensure return patronage and a reduced reliance on OTAs. For the rest of us here’s a few ideas:

Room Grades

Not a new idea and well managed by many of our clients. Simply create room standard levels and sell your inventory accordingly. You know the game, Deluxe, Superior, Standard, Awful etc. I think the bit some operators miss is keeping owners informed of where they sit in the room standard ranking and how little it might take to jump to the next level. A bit of data on improved returns won’t hurt.

Refurbishment Examples

Again, not a new idea but always worth a mention. Find an owner who is prepared to do a renovation and work with them and their trades to monitor the project and costs. With the owner’s permission share the design, costs and outcome with other owners of unrenovated apartments. I’ve seen this strategy managed to great effect where the manager engaged an interior design and project management company to do up refurbishment plans and costings for individual owners as part of encouraging investment. Why wait for an owner to think about a reno when you can encourage the process from the outset?

Lease Backs

Yet another not so new idea. Lease the apartment, do your own reno and hope that the return over the lease period makes more than a standard Form 6 while paying back the renovation investment. Not for the feint hearted, particularly when hard costs such as bathrooms and kitchens are taken into account.

Sack the Owner

Again, not for the feint hearted but, if an owner simply refuses to upgrade a unit there may come a time where the guest experience will have an unacceptable negative impact on the entire property. I have been surprised by the number of times resident managers employ this tactic and find that it’s just what’s required to get an owner to spend some money.

Renovation Funding

A hot topic at the moment and we have had some pretty interesting discussions with niche lenders trying to come up with a workable model. Unlike a hotel or motel operator who owns or leases the entirety of their property the management rights owner has no direct control over the interior presentation of units. More importantly they have no mechanism for borrowing money against those units and using the funds to do upgrades and renovations. On the flip side many unit owners either can’t be bothered or don’t have the financial capacity to undertake upgrades, particularly for bigger ticket items like kitchens and wet areas.

Discussions have taken place around a model in which the manager would fund refurbishments via a niche lender debt funding facility with repayments coming from letting commission retained. The obvious challenge here is that the owner could terminate the letting appointment leaving the manager to pursue debt collection options which would almost certainly prove a nightmare. I am also concerned that such a debt facility may cause concern to the resident manager’s primary bankers.

A more appealing option, albeit still to be fleshed out, would be a niche debt facility provided to the owners as a group and repaid via the resident manager from a portion of letting commissions. The liability would be carried by the owners with the facility working in a not dissimilar fashion to current well accepted strata lending for common area works. The challenge is to take common area debt funding standards and make them work for groups of owners. Watch this space and please feel free to offer any suggestions.

In closing I know you’re wondering. Yep, we rebooked the same unit at Coolangatta for next year. We have suggested to the manager that the owner give it a freshen up………….time will tell.

“The challenge is amplified by the fact that much of this stock is management rights based with resident managers having little control over the capacity or desire of individual owners to keep their apartments up to a suitable standard. ”

This is the one issue with our management rights model in Australia. Overseas they seem to work more on time-share style ownership, giving resort managers far greater scope for quality control within resorts. We got so sick of staying in inconsistent units (even within the same complex) that we eventually bought our own and renovated it to our own taste. It’s still problematic though because the rest of the building doesn’t follow suit so you attract a poor quality of guest who invariably damage the unit and the cycle continues. Our onsite managers are quite helpful though, they pay us higher rent as reward for the better unit, and they are also very pro-active in suggesting improvements, and quoting these works in-bulk for multiple units at once (making them cheaper). For instance they managed to get all the cupboard doors in the entire unit resprayed in beautiful 2-pack white for under two grand because so many owners agreed at once, letting the manager handle it also took all the hassle out of it as well. It’s a difficult situation to resolve and I’ve often wondered what the solution is. Great advice Mike.

Great article Mike. Having worked with managers for many years to help them and their owners improve their apartments, this is a common issue we hear everyday, with the main issue…affordability. Realistically owners cant afford NOT to improve their properties. There really is no cost, improvements are an investment back into their asset. If done correctly, with the right advice, improvements need not be “expensive”. It reduces the risk of the property devaluing plus increases equity and yields. We know that better presented properties do receive better tariff rates and occupancy. Managers benefit greatly, less complaints and increased revenue…which means increase business value. It really is a Win Win.

This is all very well but with returns to owners in the region of 30/40% of the takings because of cleaning,agents commissions,advertising etc.not to mention eye watering power bills, Body Corp charges,rates,etc etc.even though property is well maintained by owners perhaps managers should take a look at themselves. On the other hand when booking elsewhere we don’t go back to shabby places. Also,if other units in the complex are shabby it rubs off on the good guys for word of mouth advertising.