Did you know you could be missing out on thousands of dollars in tax deductions by not taking advantage of your depreciation entitlements?

The Australian Taxation Office (ATO) allows the owners of income producing properties to claim depreciation deductions relating to the wear and tear of the building structure and the plant and equipment assets it contains.

By claiming depreciation, hotel and motel owners essentially will reduce their taxable income, therefore they will pay less cash. What’s more, the fee to obtain a tax depreciation schedule outlining all of the deductions available to be claimed is 100% tax deductible.

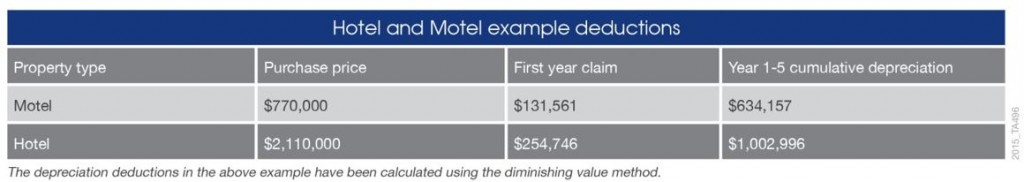

You could be missing out on:

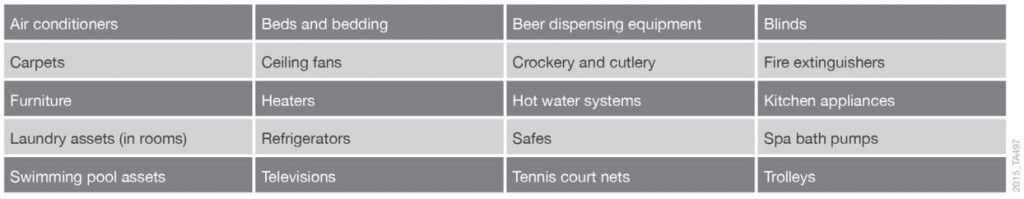

Deductible items you could claim include:

We guarantee to double our fee in deductions or we will not charge:

To learn more about the depreciation deductions you can claim for your hotel or motel, speak to the experts at BMT Tax Depreciation on1300 728 726 today.

Article provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS) is the Chief Executive Officer of BMT Tax Depreciation.

Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.